3 Steps to Crash-Proof Your Retirement Plan

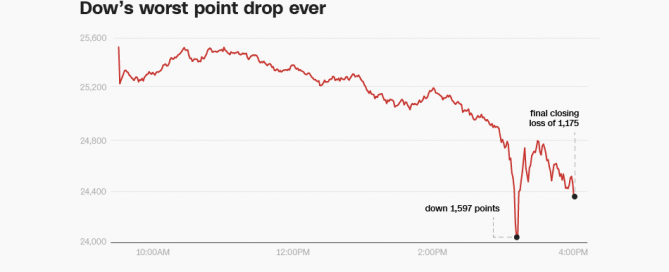

Source: Factset The post-recession bull market is starting to slow down as evidenced by yesterday’s worst single-day point decline in Dow history. The previous record was set on September 29th, 2008 when the Dow fell 777 points. Now, it’s more important than ever to make sure that your retirement plan is ready for anything. By [...]